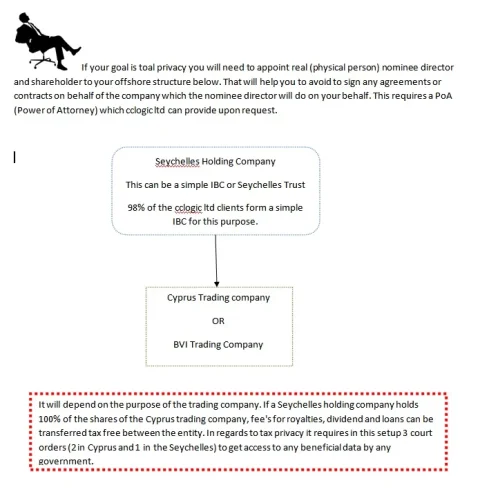

To show you what would be a very good and advanced way to secure your privacy and anonymity when trading online or even offline and to protect your tax privacy, we have made the beloq draw for your convience.

It is not the most sufisticated setup, I admit, but it is much better than a simple offshore company without nominees nor a holding company holding the shares in the trading company. Also if the purpose is to do Internet business then still you will need to make up with your self if you rather want to form a Cyprus or BVI company.

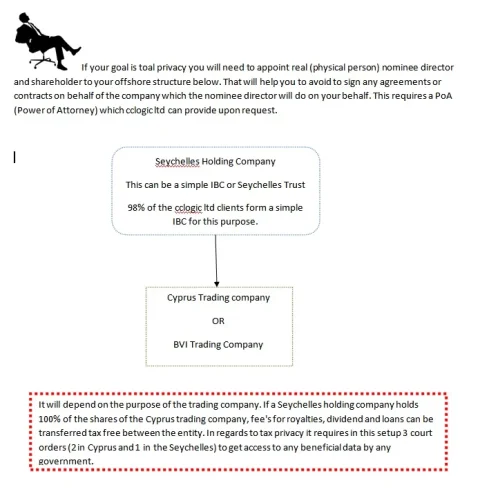

Cyprus has the benefits mentioned in the red box above, a BVI company is most often used only for the purpose to apply for a Merchant Account within the EU boarders and from there to transfer the money to the holding company in case something goes wrong.If you decide to register a BVI company for the above mentioned purpose, you will not want to start to form the Seychelles holding company, you will want to wait and start with the BVI company formation first, then open a bank account for instant in Cyprus and then apply for the merchant account for this company.

Once the merchant account is approved and operative, you form the Seychelles Holding company and transfer all shares from the BVI company to the Holding. The reasons for why we are doing it this way is the heavy due diligence the merchant procider must do. They will require all DATA including beneficial owner data of ALL involved entities in such a structure. So at this point you want have any anonymity towards your payment processor but once verything is transfered and nominees are appointed it requires only 1 letter (we will provide) to transform the whole thing to a fully protected setup.

If you have any questions or need to know more, just post here so I will be happy to help you. I will add a few more scenarious during time for instant how a Trust or Foundation will add up another layer of protection.Please note that the setup above is not a static solution that may fit's everyones needs, it is an example on how things can be done. Furthermore you will note that this is not a cheap setup and it requires knowledge from our experts to set this up correctly and also to be supported afterwards if you should ever get any troubles with any tax authority, lenders or creditors, that's where we are coming into play again after the setup and that's again where many Agent's fail!

Last edited: Oct 16, 2016

Toggle signature

It is not the most sufisticated setup, I admit, but it is much better than a simple offshore company without nominees nor a holding company holding the shares in the trading company. Also if the purpose is to do Internet business then still you will need to make up with your self if you rather want to form a Cyprus or BVI company.

Cyprus has the benefits mentioned in the red box above, a BVI company is most often used only for the purpose to apply for a Merchant Account within the EU boarders and from there to transfer the money to the holding company in case something goes wrong.If you decide to register a BVI company for the above mentioned purpose, you will not want to start to form the Seychelles holding company, you will want to wait and start with the BVI company formation first, then open a bank account for instant in Cyprus and then apply for the merchant account for this company.

Once the merchant account is approved and operative, you form the Seychelles Holding company and transfer all shares from the BVI company to the Holding. The reasons for why we are doing it this way is the heavy due diligence the merchant procider must do. They will require all DATA including beneficial owner data of ALL involved entities in such a structure. So at this point you want have any anonymity towards your payment processor but once verything is transfered and nominees are appointed it requires only 1 letter (we will provide) to transform the whole thing to a fully protected setup.

If you have any questions or need to know more, just post here so I will be happy to help you. I will add a few more scenarious during time for instant how a Trust or Foundation will add up another layer of protection.Please note that the setup above is not a static solution that may fit's everyones needs, it is an example on how things can be done. Furthermore you will note that this is not a cheap setup and it requires knowledge from our experts to set this up correctly and also to be supported afterwards if you should ever get any troubles with any tax authority, lenders or creditors, that's where we are coming into play again after the setup and that's again where many Agent's fail!

Last edited: Oct 16, 2016

Toggle signature

Latest Video Interviews, Offshore Company Resources, Payment Processing Tips & Tricks, Articles and Anonymity Hints only a click away!

Support the Freedom of Speech of our Community

Disclaimer: Nothing I say should be taken as tax, legal or financial advice. Anything I say is for general informational purposes only. Always seek independent professional advice.

Support the Freedom of Speech of our Community

Disclaimer: Nothing I say should be taken as tax, legal or financial advice. Anything I say is for general informational purposes only. Always seek independent professional advice.