Don said:

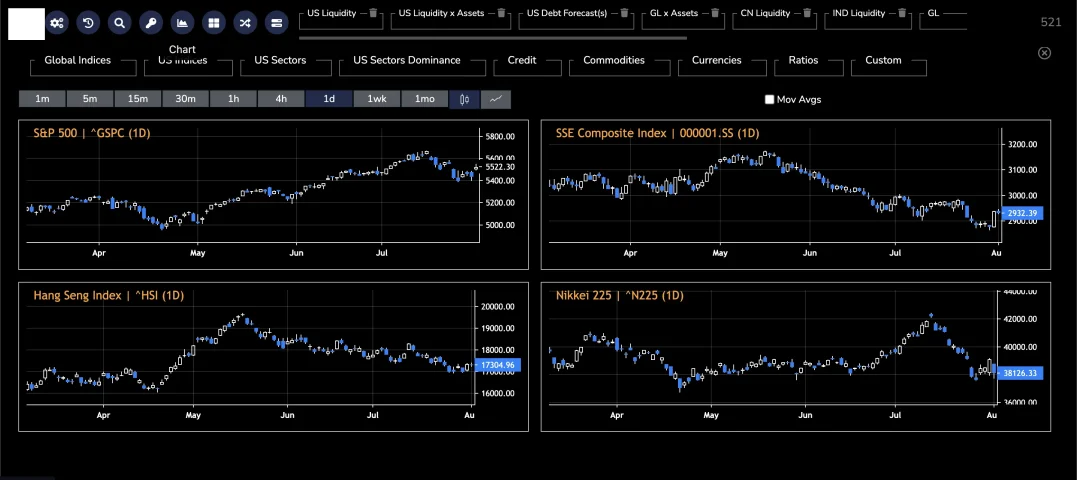

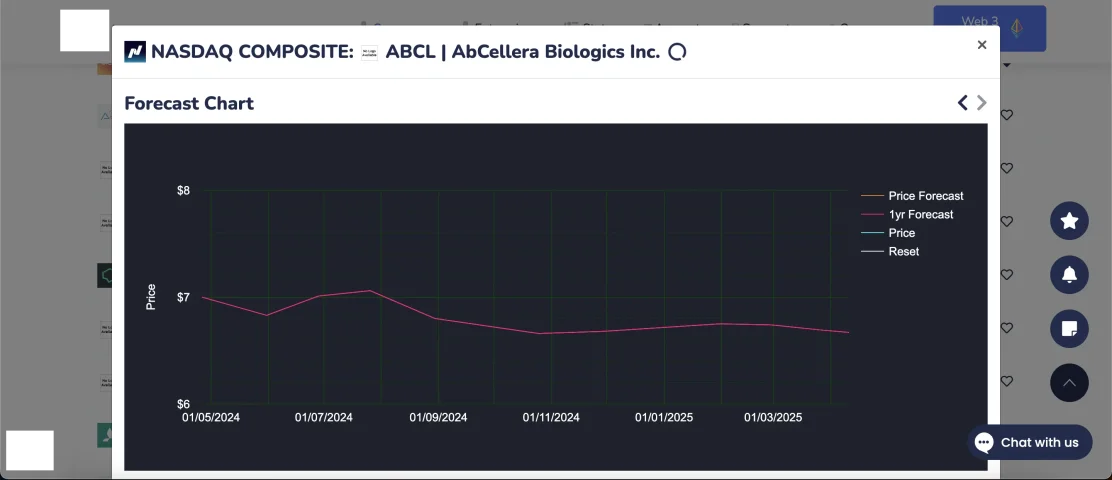

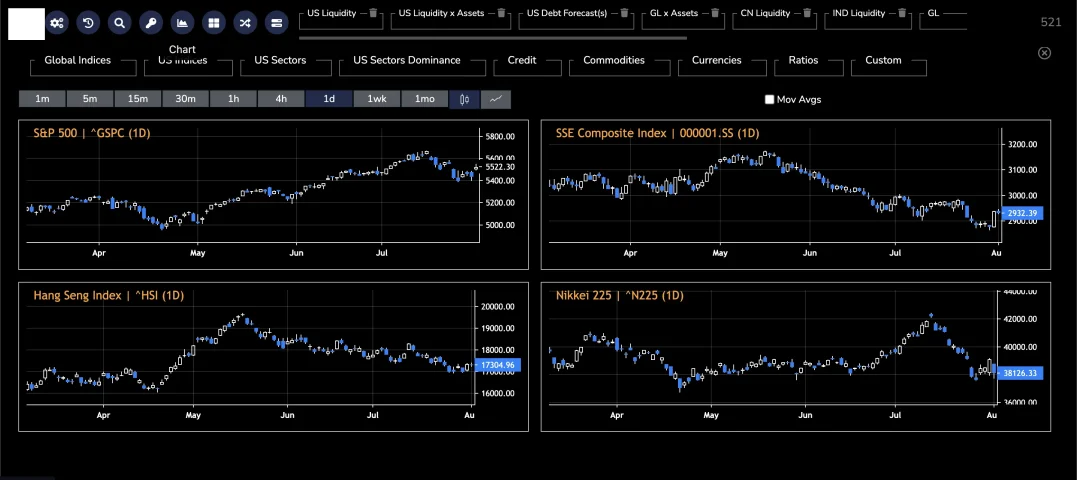

NASDAQ has been down 6.59% since the past month.

Any comments on forecasts?

@wellington

Perhaps it's the start of the cycle end?

Click to expand...

Markets usually lead economy, economy is in the shitter...

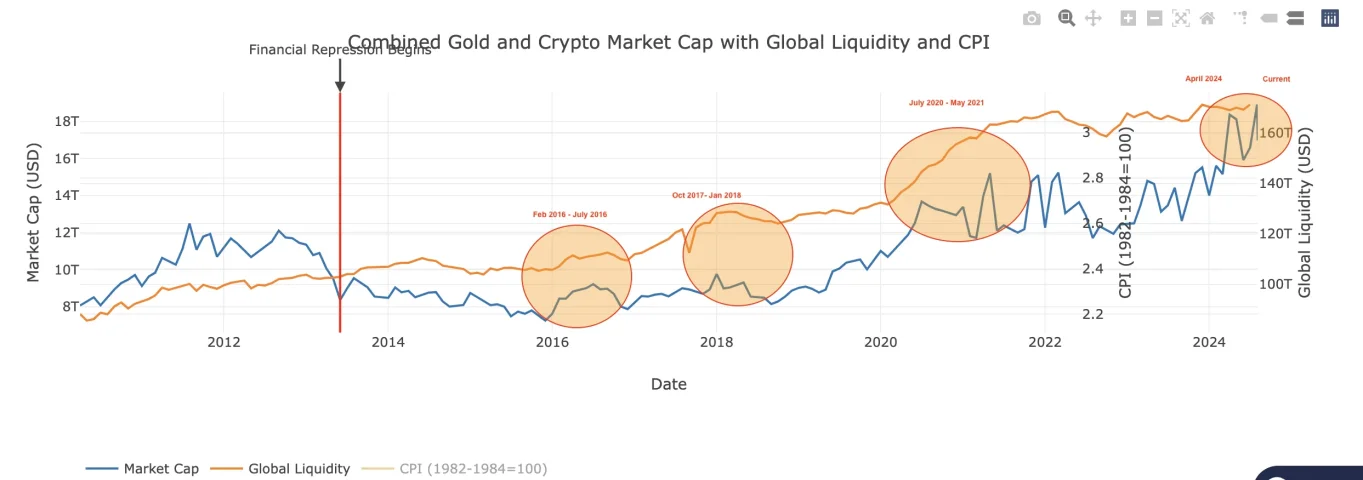

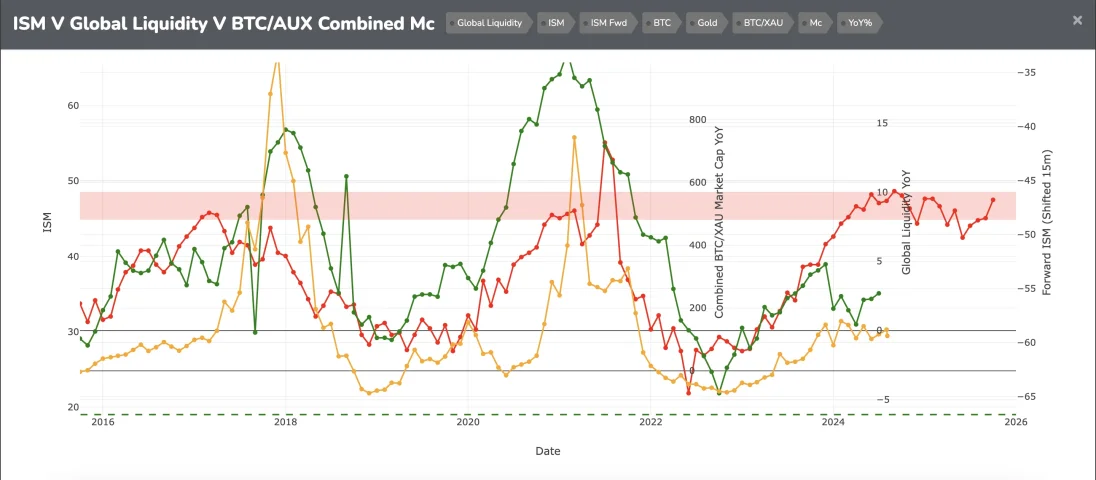

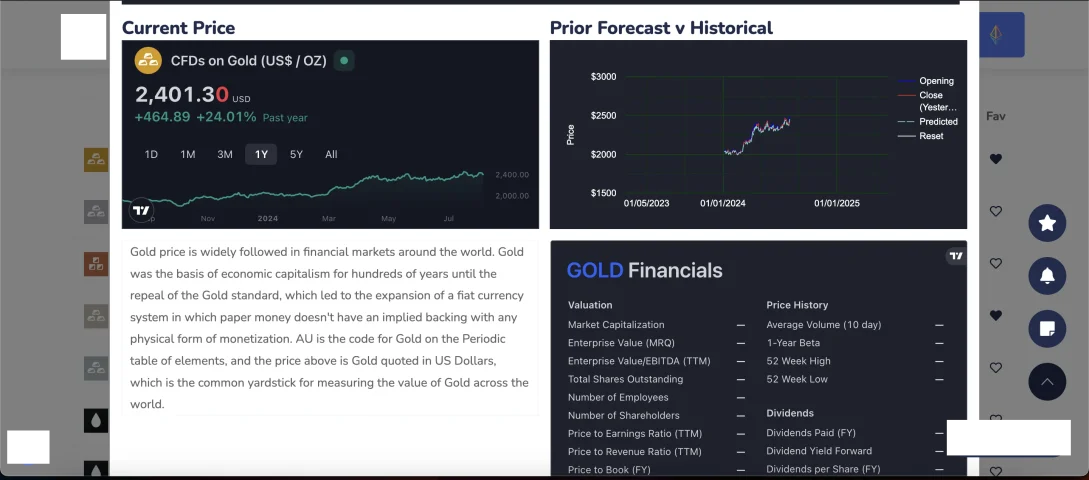

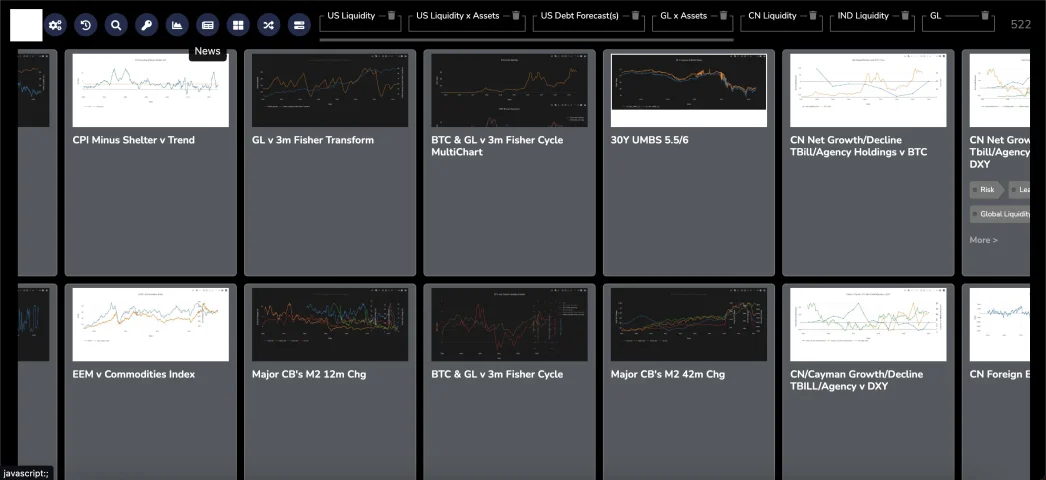

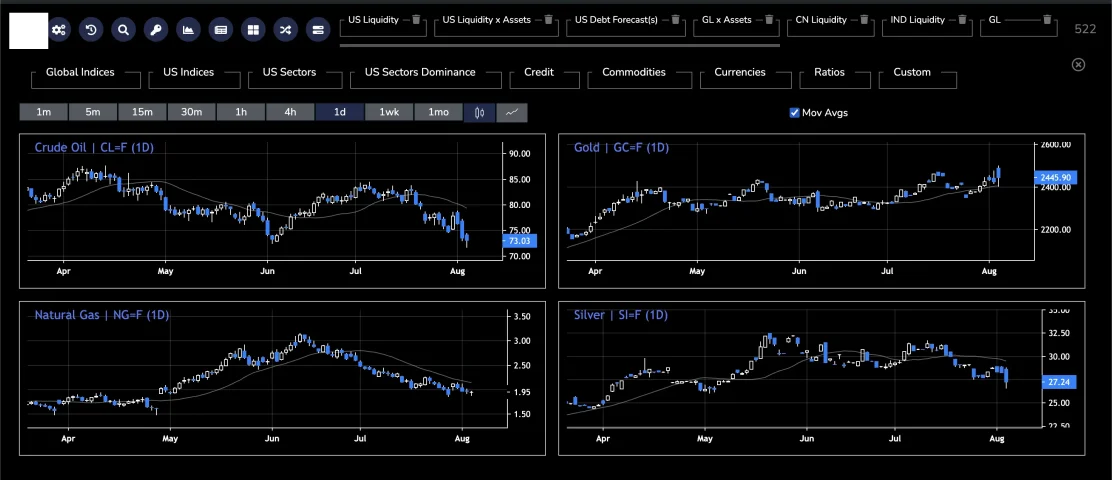

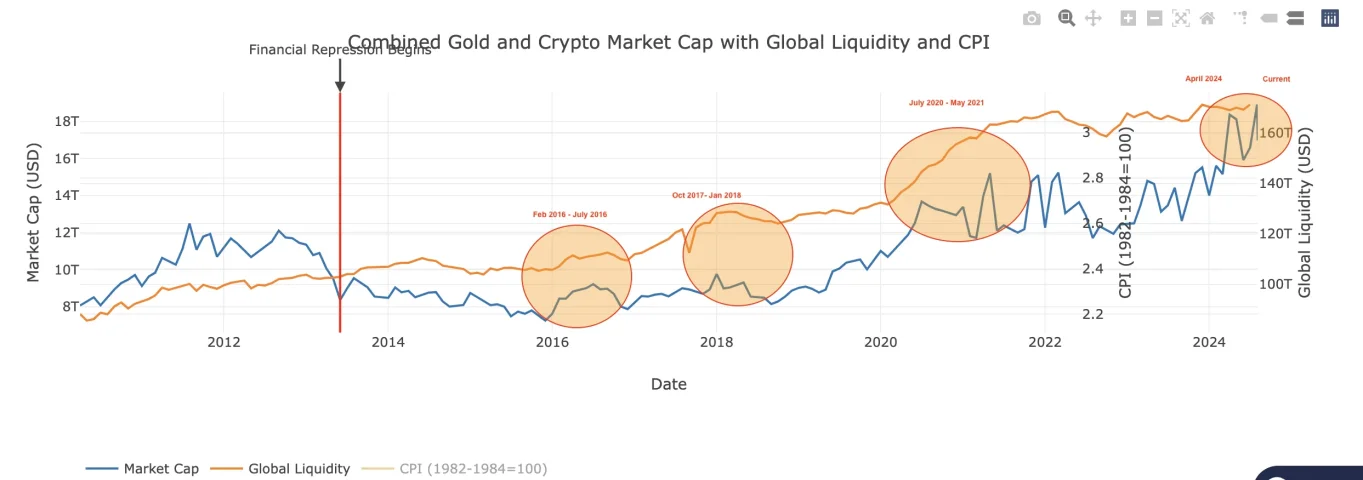

We hit the top of Liquidity (Gold-BTC v Liquidity around March period) but there's 10-16 trillion of refinancing this year) reminiscent of early-mid 2019 to me.

Prior BTC-XAU v GL

Peaked in April 24, then tried again (current failed)

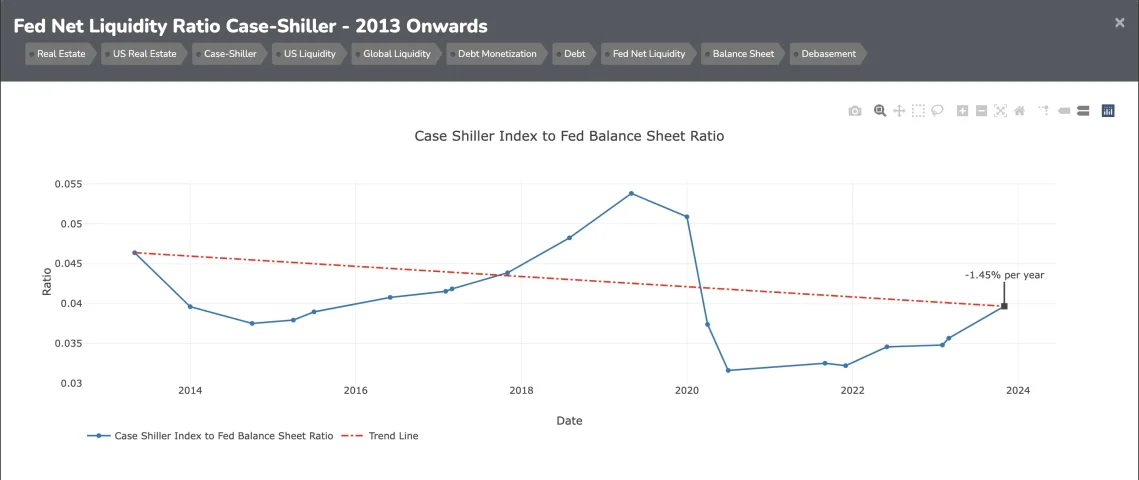

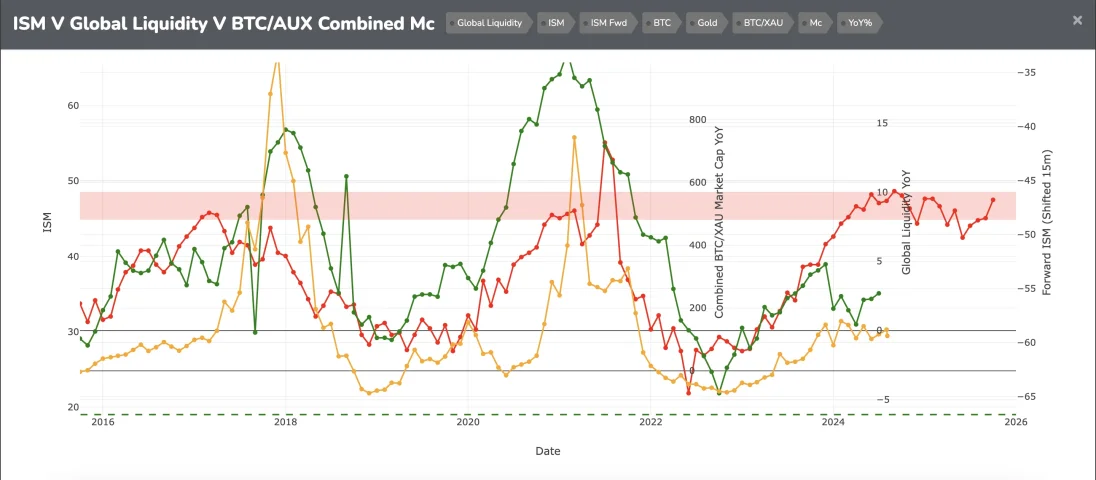

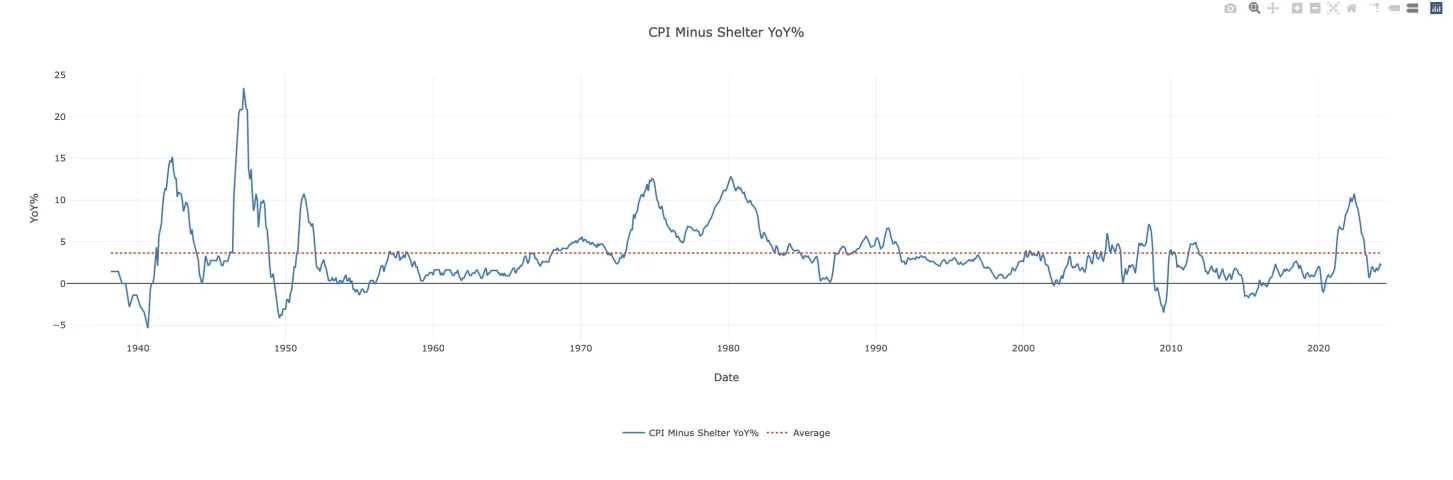

This one i find interesting as it's over time, and YoY value(s) which would lead me to believe either a break out, or a break down - either way a new longer-term trend is on the horizon.

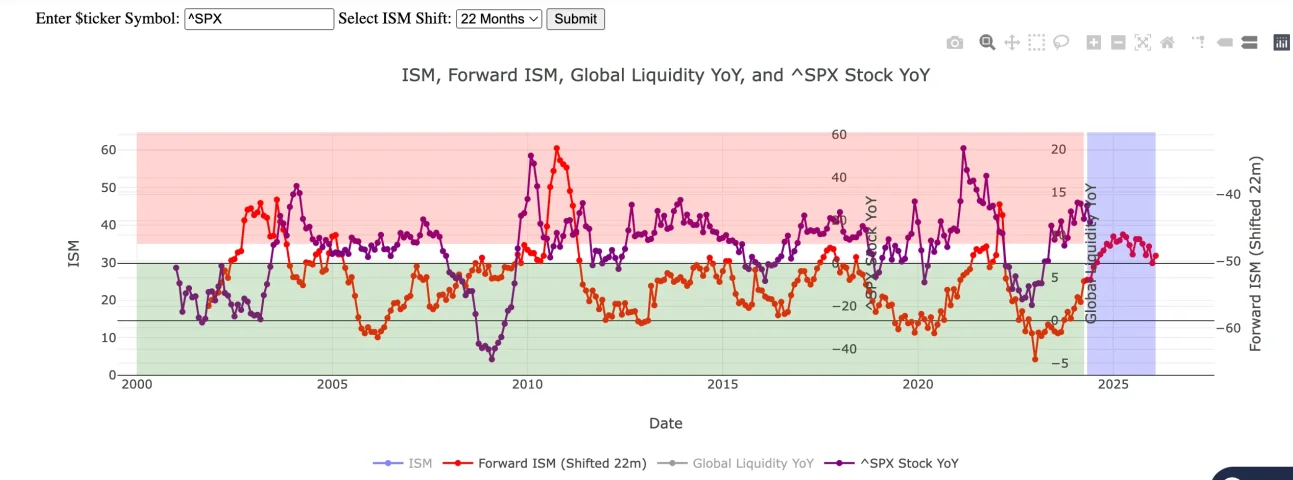

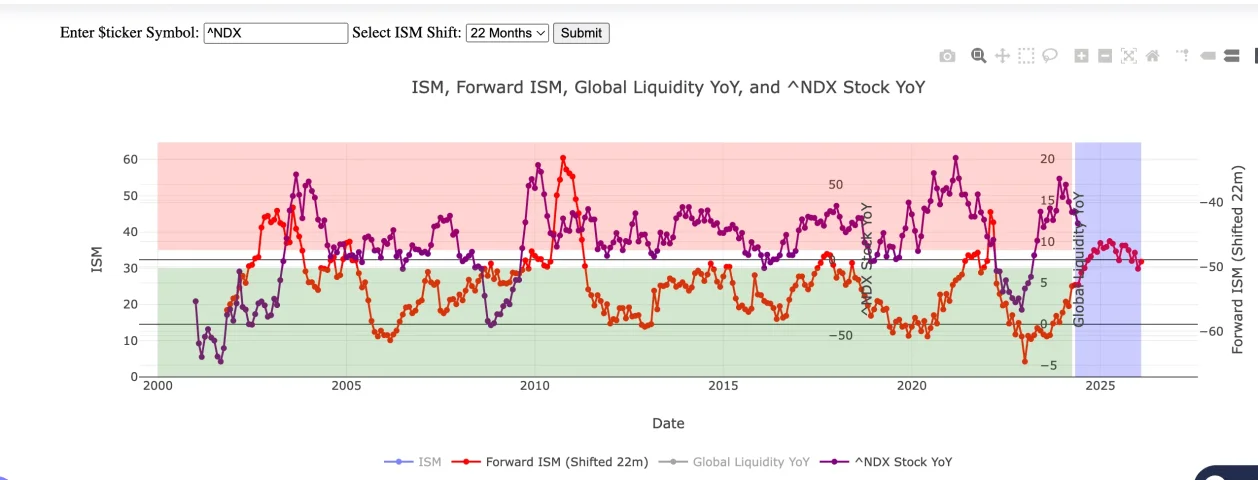

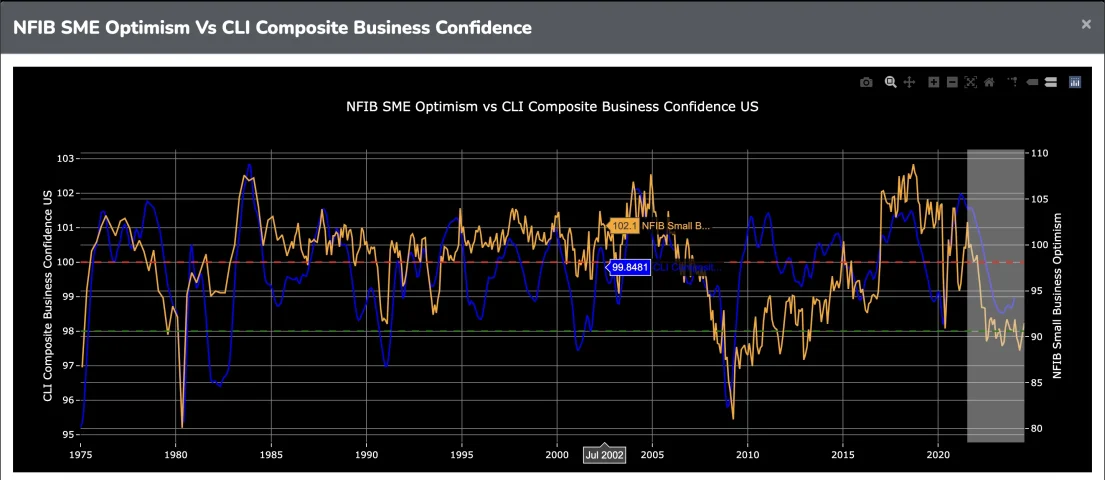

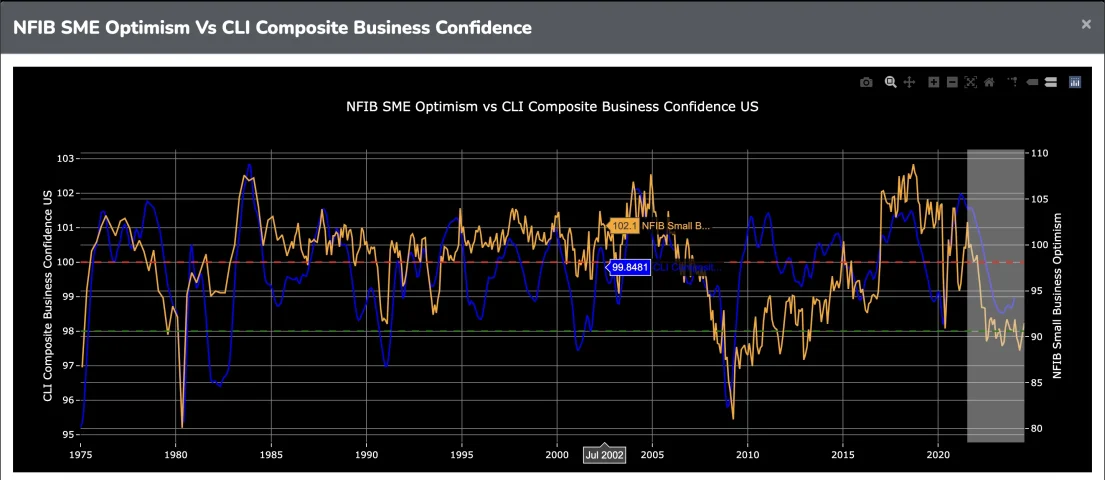

Then if we look at the economic side, bottoming in various sectors (important) survey wise (US) bare in mind the economy lags markets, markets react to liquidity and risk change.

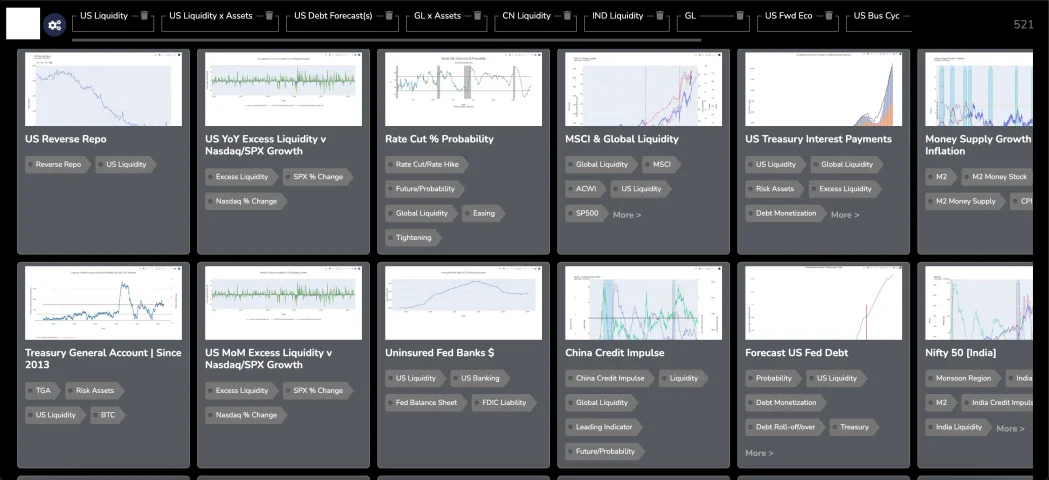

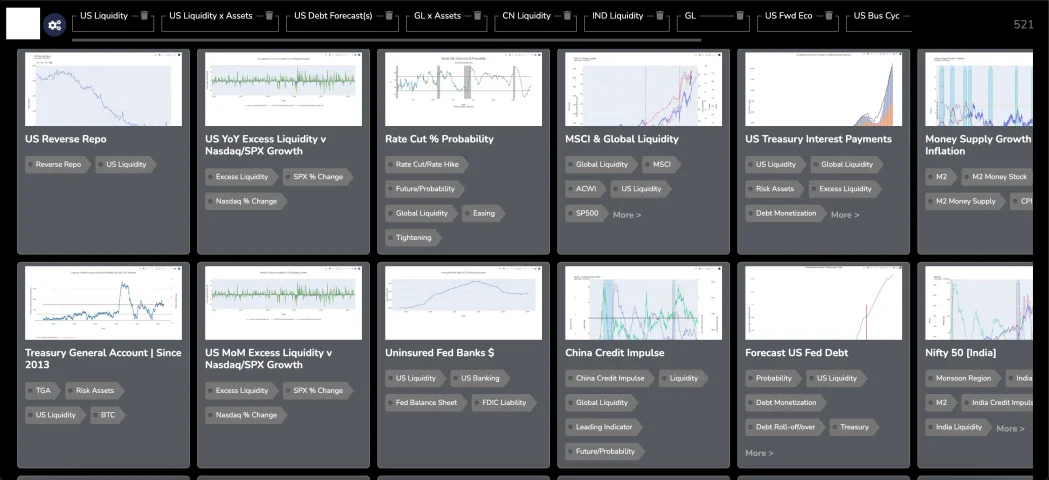

I do have some custom 5xx charts for tracking short/mid-term but i won't go re-posting all from that and counting in the 65m refi cycle a bit of nasty noise mid-term otherwise long-term carry on. (been building a terminal of sorts to make it easier to track)

FYI First chart normally marks the end of the cycle...

BUT this year is different -> 10-16 Trillion $ of State debt refinanced, then 75-130 Trillion $ of private sector/commerce debt.

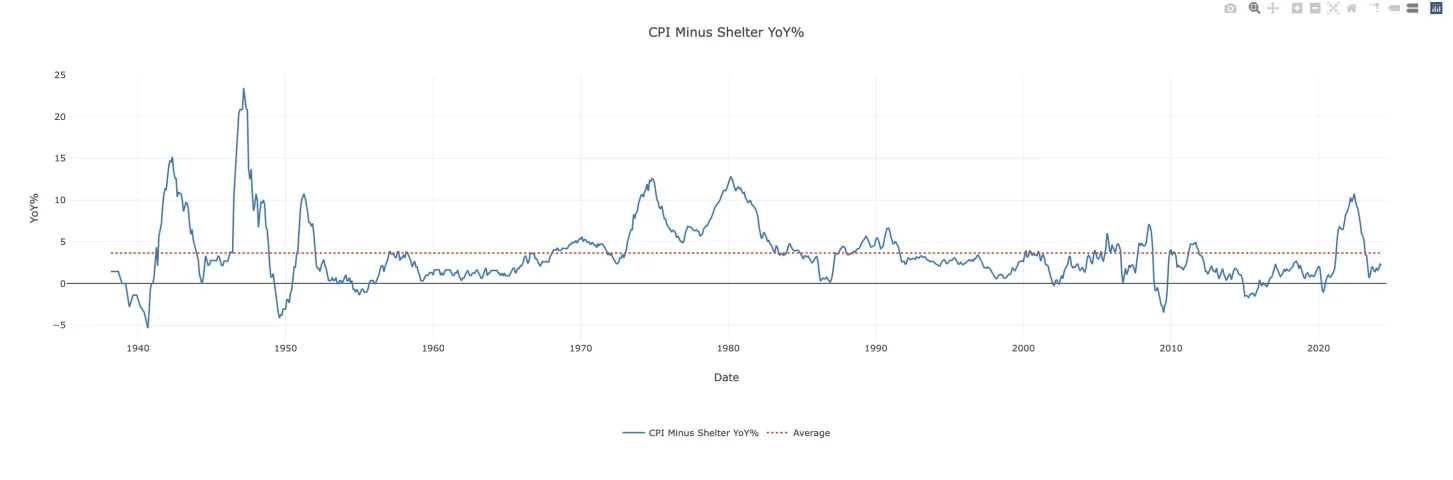

But with the need to kill inflation, it might be a two pronged approach, refinance at current or near current rates and kill inflation over the next two years and then re-finance again in two years.

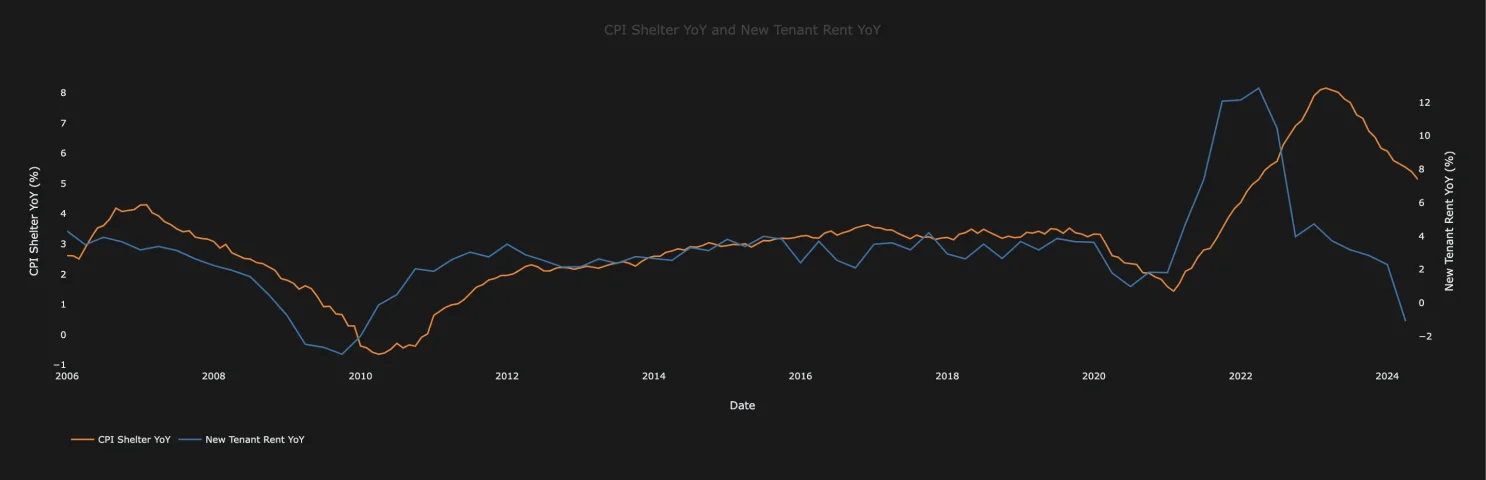

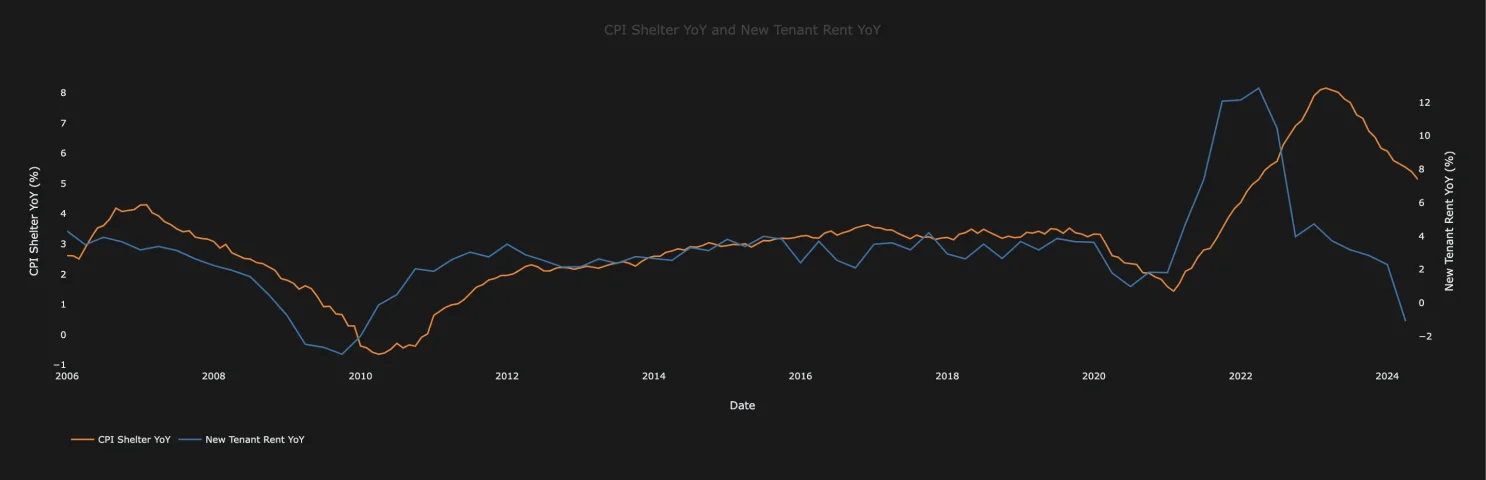

having said that shelter is usually the last shoe to drop in inflation

That being currently 2.2% roughly (inflation ex Shelter)

Shelter should be down in 3-6m dependent on the economy crashing or slowly grinding.

JohnnyDoe said:

@wellington you should start your own newsletter, one chart per week and soon you will show up on CNBC

Click to expand...

The company generates far more than the talking heads showing up on CNBC

Last edited: Aug 5, 2024