Portugal, St Kitts And Nevis Sign TIEA

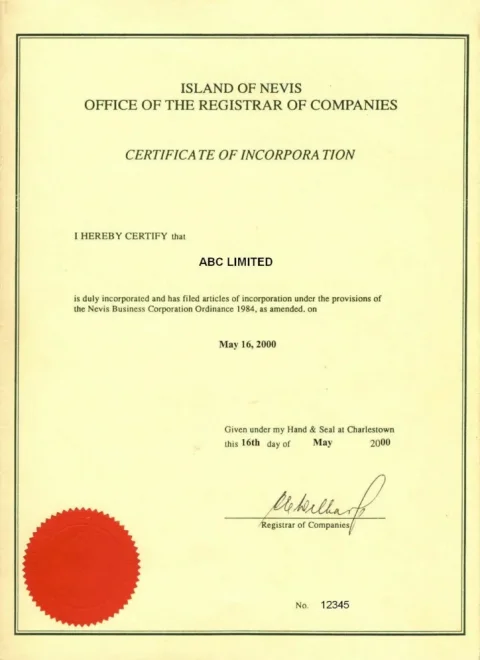

The Portuguese government has announced the signing of a Tax Information Exchange Agreement (TIEA) with the Caribbean territory of Saint Kitts and Nevis.

The agreement joins other agreements signed by Portugal, with Saint Lucia, the Isle of Man, Jersey, Guernsey, Bermuda, the Cayman Islands, Andorra and Gibraltar, bringing the country's total of such reciprocal pacts to nine.

Each agreement is based on the Organisation for Economic Cooperation and Development's model agreement on transparency and tax information exchange. When the respective agreements enter into force, they will allow Portugal and the signatory country to obtain information on request in civil and criminal tax disputes. The Portuguese government noted that the latest TIEA with St. Kitts and Nevis would help in efforts to mitigate tax fraud and evasion.

Portugal hopes to have its signed agreements ratified so that they can enter into force by 2011.

Click to expand...